The Enigmatic Journey of Masayoshi Son: Visionary Investor or Reckless Gambler?

You've probably heard the story: In 2000, when Jack Ma and Alibaba were in desperate need of funding, a Japanese tycoon extended an olive branch. After a mere five-minute conversation, he invested a staggering \$20 million, not only rescuing Alibaba but also securing his place in history as one of the most successful venture capitalists. This investment later multiplied 3,000 times over.

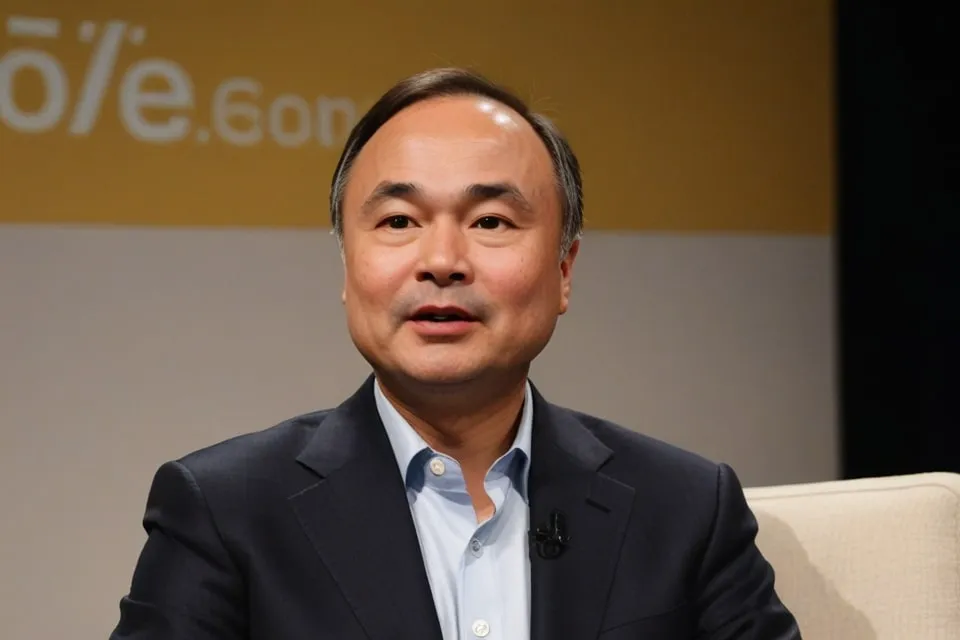

This tycoon was none other than Masayoshi Son.

Investing in Alibaba was just one of the many defining moments in Son's extraordinary life. He has consistently ranked as Japan's richest person and even held the title of the world's richest for a day. However, I find his aggressive investment philosophy to be the most captivating aspect of his journey.

His \$100 billion Vision Fund has swept across the globe, leaving its mark on tech unicorns in every corner of the world. Wherever it goes, it stirs up a frenzy in the world of capital.

Today, let's delve into the world of the man behind Jack Ma – Masayoshi Son.

SoftBank: An Unconventional Empire

You've probably heard of SoftBank. But if I were to ask you what it does, you'd likely struggle to give a straightforward answer. SoftBank is a complex and unconventional company.

After my explanation, you'll have a clear understanding of this intricate entity.

A Glimpse into Son's Early Life

Masayoshi Son, a Korean-Japanese, was born in Japan in 1957. He was an exceptionally bright and hardworking student. However, young Son possessed a quality that set him apart from his peers – an unquenchable thirst for adventure.

At the age of 16, after reading a business bestseller by the president of McDonald's Japan, Son had an epiphany. He was captivated by the world of business and determined to become an entrepreneur. While this might sound like a typical ambitious teenager, Son's next move was anything but ordinary.

He decided he had to meet the author, Den Fujita. Through sheer persistence, Son managed to get Fujita's assistant on the phone and relentlessly pleaded for a meeting with his idol. After countless calls and a flight to Tokyo, Son's determination paid off. He secured a 15-minute meeting with Fujita, who gave him two pieces of advice that would shape his destiny: embrace disruption and ride the wave of technological advancements.

Fujita advised Son to experience the US and immerse himself in the world of computers. These two suggestions would profoundly impact Son's life.

The Making of a Young Entrepreneur

Following Fujita's advice, 16-year-old Son embarked on a journey to California. After quickly finishing high school, he enrolled at the University of California, Berkeley.

Driven by his entrepreneurial spirit, Son challenged himself to find ways to make money in his spare time. He famously wondered, "Is there a way to make $10,000 a month, spending just five minutes every day?"

This led him on a quest for invention. In a year, he had brainstormed over 200 ideas, one of which was a pocket translator. This invention, a precursor to the electronic dictionaries popular during my childhood, was a success. Son sold the rights to Sharp for $1.7 million.

He then ventured into importing game consoles from Japan and selling them to American restaurants, which proved to be another lucrative endeavor, earning him $1.5 million. By his early twenties, Son had amassed a small fortune.

While his stories might be embellished, they offer a glimpse into his inherent entrepreneurial spirit.

The Birth of SoftBank

In 1981, armed with a few hundred thousand dollars, 24-year-old Son returned to Tokyo. While this amount of money was already beyond the wildest dreams of many, Son, fueled by his risk appetite, was just getting started.

After careful consideration, he decided to establish a software distributor, essentially acting as a middleman between software developers and computer retailers. The name SoftBank, a play on "Software Bank," was born.

SoftBank thrived in the burgeoning software distribution market. It further solidified its presence by publishing computer magazines, which helped promote its distribution business.

By 1994, SoftBank went public with a valuation of $3 billion. This marked the end of SoftBank's first chapter.

While going public is a significant achievement for most companies, for Son, it was merely the beginning. He had secured the capital to play in the big leagues.

Riding the Dot-Com Wave: Yahoo and Alibaba

After going public, Son had the resources to make game-changing moves. He believed in identifying macro trends and positioning himself to ride the wave. He wasn't interested in the intricacies of product innovation or daily operations. He wanted to identify a promising sector, such as the internet, and invest heavily in companies within that space.

This strategy led to Son's first major investment triumph. In 1995, he set his sights on a rapidly growing company called Yahoo. At the time, Yahoo was a small startup with only 15 employees.

Son, in his characteristically bold fashion, offered $100 million for a 30% stake in the company. Yahoo's founder, Jerry Yang, was taken aback by the offer and hesitated. While the money was tempting, the dilution of 30% of the company's shares was a significant concern.

Sensing hesitation, Son resorted to a tactic that would become a recurring theme in his investment career: He threatened to invest in Yahoo's competitors, such as Excite and Lycos, if they didn't accept his offer. This forced Yahoo's hand, and they agreed to the deal.

In 2012, when Yahoo went public on Nasdaq, Son's investment had multiplied 2.5 times over. Fueled by the dot-com bubble, Yahoo grew into a $100 billion company.

However, this wasn't even the most successful aspect of Son's investment. He wanted to leverage Yahoo's success in Japan. In 1996, SoftBank invested $72 million to form a joint venture with Yahoo, called Yahoo Japan. For an extended period, Yahoo Japan reigned supreme as the country's largest portal and search engine.

By 2004, Yahoo Japan's market capitalization reached $50 billion, surpassing its global counterpart. This investment generated hundreds of times the initial investment for SoftBank, becoming a cornerstone of its portfolio.

A few years later, Son made another legendary move by investing in Alibaba in 2000. According to Son, he was captivated by Jack Ma's vision, even though Ma lacked a comprehensive business plan. With unwavering faith in e-commerce and Ma's leadership, Son invested $20 million for a 34.4% stake in Alibaba after a brief meeting.

This investment skyrocketed in value when Alibaba went public 14 years later, reaching a staggering $600 billion—a 3,000-fold increase. At its peak in 2019-2020, Alibaba accounted for over half of SoftBank's market value.

These early and decisive investments in Yahoo and Alibaba, with their massive returns, catapulted Son to a level of recognition comparable to Warren Buffet.

While these two companies represent his most significant triumphs, they were not his only ventures during that period. Between 1996 and 2000, Son invested in 250 internet companies and other promising businesses, transforming SoftBank from a software and magazine publisher into a sprawling conglomerate.

Instead of categorizing its businesses by products, SoftBank's portfolio became incredibly diverse, encompassing software, media, internet, finance, and more.

By 1999, SoftBank Group had become a holding company, overseeing a vast network of subsidiaries with diverse operations.

Today, the SoftBank Group employs a surprisingly small number of people: 255. This relatively small headcount for a multi-billion dollar company is because it operates as a pure holding company. Its vast network of subsidiaries employs over 60,000 people, excluding the workforce of its investment portfolio companies.

This unusual structure highlights SoftBank's unique approach to business.

The Dot-Com Bubble Burst and its Aftermath

Son's unwavering belief in the internet led him to pour billions of yen into companies like Yahoo and CNET. He saw potential in the financial sector and invested heavily in companies like E*Trade and Morningstar. Recognizing the importance of technology, he acquired Kingston.

Son's and SoftBank's approach remained consistent: Identify promising trends, invest heavily, and trust in their vision.

While this strategy resulted in many unsuccessful investments, such as the case with Kingston, Son's bet on the internet during the dot-com boom paid off handsomely. His aggressive investments covered a vast swathe of internet companies. As the valuations of these companies soared, SoftBank's market capitalization reached an astronomical $200 billion, briefly making Son the world's richest person.

However, the dot-com bubble was not sustainable. When it burst, the repercussions were severe. The S\&P 500 plunged by over 40%, and the Nasdaq plummeted by over 70%. SoftBank was not spared; its market value evaporated by 99%, plummeting from $200 billion to a mere $2 billion.

Son's personal fortune of $70 billion vanished into thin air. In the aftermath, he faced immense criticism, teetering on the brink of bankruptcy. SoftBank was losing $1 billion annually, and almost every investment was hemorrhaging money. Yahoo's stock price crashed, and Alibaba's IPO was still years away.

This period marked the darkest chapter in Son's career, where he faced unimaginable pressure.

Shifting Focus: From Internet to Telecom

Forced to reassess his strategy, Son shifted his focus back to tangible industries. He needed a reliable source of revenue to support his ambitious long-term vision.

In a remarkable display of adaptability, he recognized the potential of widespread home internet adoption and ventured into broadband services in 2001, establishing Yahoo BB. He further solidified his position in 2004 by acquiring Japan Telecom, maneuvers that helped SoftBank weather the tumultuous dot-com storm.

Son then set his sights on the burgeoning smartphone market, making a strategic move into telecommunications. In an interesting turn of events, he contacted his idol, Steve Jobs.

At the time, Apple hadn't released the iPhone, but the iPod was enjoying phenomenal success. Son, ever the visionary, showed Jobs a sketch of an iPod capable of making calls, suggesting that Apple explore this concept.

Jobs, amused, revealed that Apple was already developing such a device – the iPhone. Recognizing an opportunity, Son secured an agreement with Jobs to make SoftBank the exclusive distributor of the iPhone in Japan.

Upon returning to Japan, Son aggressively expanded into the mobile market, acquiring Vodafone Japan. Two years later, when the iPhone launched, SoftBank was perfectly positioned to capitalize on its success.

SoftBank later acquired Sprint, a US telecom operator, and with the help of President Trump, orchestrated a merger between Sprint and T-Mobile.

This telecommunications arm, initially known as Vodafone Japan, was later rebranded as SoftBank Corp. It's important to distinguish between SoftBank Group, the holding company, and SoftBank Corp., the telecommunications subsidiary, to avoid confusion.

Son's foray into telecommunications proved to be a lifeline for SoftBank. From 2005 onward, the company returned to profitability, and revenue steadily increased. In 2014, his earlier investment in Alibaba finally bore fruit as the company went public, providing SoftBank with a much-needed financial cushion and allowing Son to confidently re-enter the world of investments.

A New Era of Investment: The Vision Funds

In 2016, Son identified another promising area for investment – microprocessors – setting his sights on the semiconductor giant ARM.

Despite criticism from those who believed he overpaid, Son, in his characteristically bold style, acquired ARM for $32 billion. He was more concerned about missing out on a transformative opportunity than overpaying. Today, ARM's technology powers over 95% of smartphone chips, including Apple's M series, validating Son's foresight. ARM has become a significant pillar for the SoftBank Group.

However, even the acquisition of ARM couldn't satisfy Son's grand vision. In 2010, he unveiled his ambitious 30-year plan for SoftBank, which remains a prominent feature on the company's website.

Son believes that understanding SoftBank's future requires understanding the trajectory of humanity. He predicts that within a few decades, computers will surpass human intelligence, leading to the singularity – a point in time where technological growth becomes uncontrollable, resulting in unforeseeable changes to human civilization.

Son envisions SoftBank at the forefront of this technological revolution, shaping the future through strategic investments. The recent explosion of AI, particularly with ChatGPT, seems to suggest that the singularity might be closer than we think.

To realize this ambitious vision, Son requires more than just ARM or SoftBank Corp. He wants to be a driving force behind humanity's technological advancement. This desire led him to explore robotics with Pepper and acquire Boston Dynamics, both of which ultimately fell short of his expectations.

Recognizing that SoftBank's financial resources alone were insufficient to achieve his vision, Son decided to establish a venture capital fund in 2017. This fund, dubbed the Vision Fund, was unlike anything the world had ever seen, with a staggering $100 billion war chest dedicated to investing in companies shaping the future.

The Vision Fund: A $100 Billion Gamble

To amass such a vast sum, Son turned to Saudi Arabia's Crown Prince Mohammed bin Salman (MBS), a man known for his wealth and willingness to invest in ambitious projects. In another one of his legendary pitches, Son reportedly told MBS that he had a $1 trillion gift for him, piquing the Crown Prince's interest.

While the details might be apocryphal, the fact remains that Son secured a $45 billion investment from Saudi Arabia after a mere 45-minute meeting with MBS. To put this into perspective, $45 billion was enough to place the Vision Fund among the top ten hedge funds globally.

MBS's investment stemmed from a combination of factors. He recognized the need to diversify Saudi Arabia's oil-dependent economy and was impressed by Son's track record.

With almost half of the Vision Fund secured, raising the remaining $55 billion was relatively straightforward. Son secured an additional $15 billion from the United Arab Emirates, committed $28 billion of SoftBank's own capital, and raised the rest from prominent investors like Apple, Qualcomm, and Foxconn.

Thus, the world's most audacious tech fund was born, marking a new chapter in SoftBank's investment journey.

With $100 billion at his disposal and an aggressive investment style, Son wasted no time in deploying capital. He recognized that the winner-takes-all dynamics of the internet and emerging technologies demanded swift action and a dominant market share.

His strategy was simple: Identify companies with high growth potential, invest significant sums to secure a controlling stake, and push for rapid expansion and global domination.

Son understood that this approach would disrupt traditional funding models and force entire industries into a hyper-competitive, cash-intensive race. He wasn't afraid to shake things up.

Within three years, Son had invested over $80 billion in more than 80 companies, including notable names like Didi, Uber, WeWork, Coupang, Grab, and ZhongAn Insurance.

When the initial $100 billion proved insufficient, he attempted to raise another $100 billion for Vision Fund 2. However, the aggressive, hit-or-miss nature of the first Vision Fund had made investors wary.

Consequently, Vision Fund 2 primarily relied on SoftBank's own capital, raising only $56 billion from external investors. This time, Son adopted a more cautious approach, focusing on earlier-stage companies and making smaller investments.

In addition to the two Vision Funds, Son also established a $7 billion Latin America Fund in 2019, further expanding SoftBank's global reach. These three funds represent a significant portion of SoftBank's current portfolio and are widely regarded as its most defining feature.

SoftBank's Portfolio: A Mixed Bag of Success and Failure

To understand SoftBank's current structure, let's break down its portfolio:

- Mobile Business: This segment, represented by SoftBank Corp., along with LINE (Japan's dominant messaging app) and stakes in T-Mobile and Deutsche Telekom, generates the majority of SoftBank's $60 billion annual revenue. Despite its revenue contribution, this segment only accounts for a small fraction of SoftBank's total valuation.

- ARM Holdings: The semiconductor giant ARM constitutes a significant portion of SoftBank's portfolio. Son's bet on ARM remains a key part of his long-term strategy.

- Alibaba Stake: While SoftBank sold off a large chunk of its Alibaba shares in 2022, it still holds a 15% stake, representing a significant portion of its portfolio.

- Vision Fund Investments: The Vision Funds and the Latin America Fund, with a combined portfolio valued at approximately $700-800 billion (considering only SoftBank's contributed capital), represent the most substantial portion of SoftBank's portfolio.

- Other Holdings: The remaining portion of SoftBank's portfolio consists of a diverse range of smaller businesses and investments.

SoftBank's stock price is heavily influenced by the performance of its investment portfolio, particularly the Vision Funds, Alibaba, and ARM. Since ARM is not yet publicly traded, fluctuations in SoftBank's share price are often correlated with the performance of the Vision Funds and Alibaba.

This heavy reliance on investment income reinforces the perception of SoftBank as an investment company rather than a traditional conglomerate.

Evaluating Son's Legacy: Genius or Gambler?

Son's investment track record is a mixed bag of remarkable successes and high-profile failures. While he has an undeniable knack for identifying promising trends, his aggressive, high-stakes approach has drawn criticism.

One of Son's most notable failures was his investment in WeWork. Perhaps hoping to replicate his success with Jack Ma, Son became enamored with WeWork's co-founder, Adam Neumann.

After a brief meeting, Son was convinced that Neumann's unconventional personality and ambitious vision would revolutionize the co-working space.

He invested a staggering $44 billion in WeWork, even telling Neumann, "You are not crazy enough," as he left the meeting.

However, Neumann's extravagance and WeWork's unsustainable business model soon caught up with them. Their attempts to go public were met with skepticism and scrutiny, revealing serious financial issues and a grossly inflated valuation.

To salvage his investment, Son poured another $9.5 billion into WeWork, acquiring a majority stake. The company eventually went public but at a valuation of $15 billion, a far cry from its peak valuation.

SoftBank's total losses on WeWork exceeded $10 billion, marking one of the biggest investment blunders in history. Son himself admitted that it was one of his worst investments.

Another significant setback was his investment in Didi, the Chinese ride-hailing giant. Despite Didi's successful IPO in 2021, regulatory crackdowns and a forced delisting from the US stock market resulted in billions of dollars in losses for SoftBank's Vision Fund.

While SoftBank has its share of successful investments, the high-profile failures like WeWork have tarnished Son's reputation, leading many to question his investment judgment and label him a reckless gambler.

These concerns are reflected in SoftBank's stock price, which often trades at a significant discount to the sum of its parts. The market seems to lack confidence in Son's unpredictable decision-making.

One notable example is the "NASDAQ Whale" incident in 2020. A mysterious buyer was aggressively purchasing call options on tech giants like Apple, Tesla, Amazon, and Microsoft, totaling a massive $40 billion. This unusual activity spooked the market, and eventually, the "Whale" was revealed to be SoftBank – Masayoshi Son.

The revelation that Son was making massive bets on short-term market movements, despite his claims of focusing on humanity's long-term future, further eroded investor trust. Regardless of whether these bets paid off, the incident highlighted his unpredictable nature, further justifying the discount on SoftBank's stock price.

The combination of the 2022 Chinese tech stock crash and the devaluation of the Japanese yen dealt a significant blow to the Vision Fund's performance, placing it among the bottom 10% of similar funds.

To stabilize the company, SoftBank resorted to layoffs, selling off Alibaba shares, and buying back its own stock.

In November 2022, Son announced that he would be taking a step back from day-to-day operations to focus on taking ARM public.

Conclusion: A Legacy Yet to be Written

Masayoshi Son's career has been a rollercoaster ride of extraordinary highs and devastating lows. Whether his successes are attributed to genius or luck remains a subject of debate.

Undoubtedly, he is a visionary with a keen eye for identifying transformative trends. However, his aggressive investment style and disregard for conventional risk management are undeniable.

While his recent setbacks have drawn criticism, it's important to remember that the world of investing is cyclical. If the tech market rebounds, SoftBank and Son could easily reclaim their former glory.

Knowing Son, he'll likely double down on his bets, perhaps even launching a $500 billion fund. Only time will tell what the future holds for this enigmatic figure.